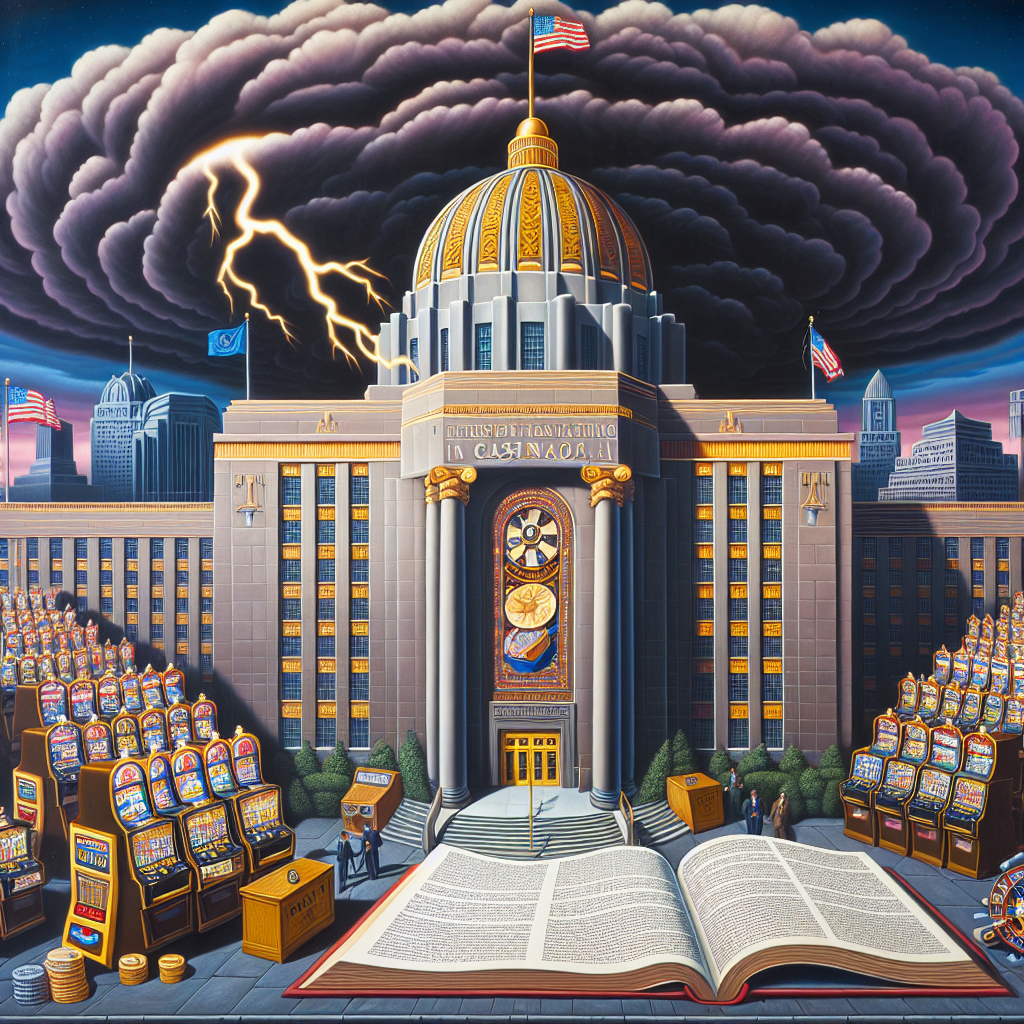

In a bold and unexpected move, Pennsylvania casinos have filed a lawsuit against the state over a controversial slot machine tax that they argue is unfair and unconstitutional. The lawsuit, filed by Lightner Communications LLC on behalf of several prominent casinos in the state, seeks to challenge the legality of the tax and have it declared invalid.

The slot machine tax in question was implemented by the Pennsylvania legislature in an effort to generate revenue for the state’s coffers. Under the current law, casinos are required to pay a tax of 54% on their slot machine revenue, one of the highest rates in the country. The casinos argue that this tax rate is excessive and places an undue burden on their businesses.

In the lawsuit, Lightner Communications LLC argues that the slot machine tax violates the Pennsylvania constitution’s prohibition on excessive and discriminatory taxation. The casinos claim that the tax unfairly targets their industry and puts them at a competitive disadvantage compared to other businesses in the state. They also argue that the high tax rate hampers their ability to attract customers and invest in new technologies and amenities.

The lawsuit has garnered significant attention in the state, with many industry experts and lawmakers weighing in on the issue. Some have expressed sympathy for the casinos’ position, arguing that the tax rate is indeed excessive and could ultimately harm the state’s gaming industry. Others, however, have defended the tax as a necessary source of revenue for the state and have called on the casinos to pay their fair share.

In response to the lawsuit, the Pennsylvania Department of Revenue has stated that they are confident in the legality of the slot machine tax and will vigorously defend it in court. They argue that the tax is essential for funding critical state programs and services, and that the casinos should not be exempt from their financial obligations.

As the legal battle unfolds, the outcome remains uncertain. The Pennsylvania casinos are prepared to fight for their rights and will stop at nothing to have the slot machine tax overturned. Whatever the final decision may be, one thing is clear – this lawsuit has the potential to reshape the gaming industry in Pennsylvania and set a precedent for future tax disputes.